The continued decline in the volume of foreign exchange supplied to

the retail market indicates that the naira is gradually strengthening

against other international currencies, the Central Bank of Nigeria,

CBN, said on Wednesday.

According to a report by Premium Times, for some time, authorized

forex dealers have not been able to clear the amount of dollars supplied

by the bank as part of its intervention to boost liquidity in the

market.

On Wednesday, out of about $100 million offered by the Central Bank

at the inter-bank wholesale transactions, only about $65.94 million was

absorbed at close of business.

Last week, dealers were equally unable to take up fully the $150

million offered by the CBN on Monday, as only about $96.37 million was

subscribe to.

Equally, on the day the bank opened the new ‘investors/exporters’

forex window, only $25 million was sold to interested customers.

On Monday, the Central Bank supplied a total of $150 million to the

interbank wholesale market for auction to authorised foreign exchange

dealers.

In spite of the decline in demand, the bank still offered another

$150 million to be auctioned at the wholesale window of the inter-bank

market to customers.

The CBN spokesperson, Isaac Okorafor said with this development,

forex market watchers said the value of the Naira was sure to strengthen

against other international currencies, particularly the dollar and

pound.

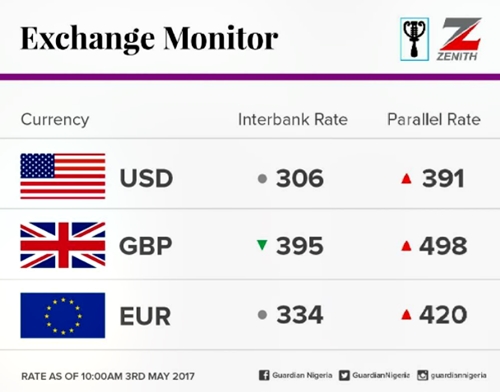

The Naira exchanged at an average of N385-N390 to the dollar on Wednesday.

Okorafor said; “There is no cause for alarm. The development

only proves that there is enough to meet the legitimate needs of genuine

customers in the market.”

To sustain the supply of forex to the market, Mr. Okorafor said the

CBN had received requests from authorised dealers on behalf of their

customers for the bank’s intervention in the retail segment of the

market.

He, however, pointed out that the Central Bank would continue to

intervene with the supply of $20,000 to dealers in the Bureau de Change

(BDC) segment this week.

The CBN, he said, was nearing its goal of rate convergence between the inter-bank and the Bureau de Change (BDCs).

He said the Central Bank governor, Godwin Emefiele, had assured

that the bank would sustain the current level of interventions in all

segments of the market.

No comments:

Post a Comment